AI-driven semiconductors: what does it mean for water resiliency?

Share this insight

As artificial intelligence reshapes the global economy, public debate has largely centred on data center cooling. Last week at Davos, Global Water Intelligence (GWI) and Xylem launched a new whitepaper, showing that total water demand across the new economy of data centers, fabs, and power generation could increase 129% by 2050. However, the analysis reveals that data center cooling is not the focus of the debate.

The bulk of AI’s water footprint sits further upstream, including chip fabrication which is projected to rise by 613% by 2050. This growth reflects a dual pressure: overall demand is rising with data centre expansion, while production is increasingly concentrated in advanced, more water-intensive chips.

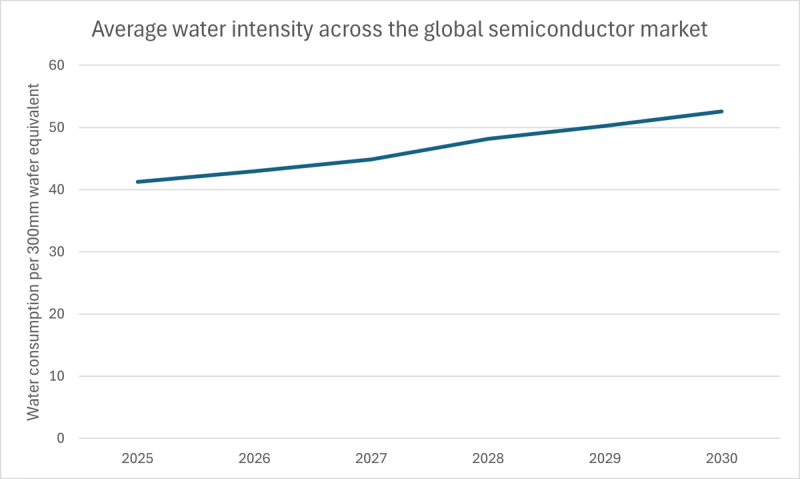

AI and high-performance chips are predominantly manufactured at the most advanced nodes (below 10 nm) to maximize computing density and efficiency. Water use is estimated from total consumption per 300 mm wafer, which accounts for all layers and additional cleaning or etching steps, not just individual mask layers. At smaller nodes, more mask layers, lithography, and CMP steps increase total water per wafer. As the industry fills demand for advanced chips, average water intensity per chip is expected to increase 27% by 2030, as illustrated in the graphic.

Semiconductor manufacturing has always been water intensive, but AI is raising the stakes, with UPW demand and purity increasing in the era of AI-specialized chips. Producing 1 m³ of UPW can require up to 4 m³ of raw water, significantly amplifying water demand.

The limits of reuse

Even accounting for efficiency gains and rising reuse, the analysis suggests semiconductor manufacturing could double in water-intensity by 2050. Onsite optimisation and reuse alone may not be enough to offset rising water demands. For example, TSMC’s process water recycling rate increased by nearly 3% points to 88% from 2021 to 2024, but in the same period, per-layer water intensity rose 34%, pushing up total water use.

Technical limitations continue to exist – for example, challenges remain in offsetting cooling tower evaporation, as well as UPW recycling. In the manufacturing process, UPW accumulates low-molecular-weight organics that are hard to remove, posing a risk to wafer yield. However, the paper highlights that pressure from increasing water scarcity will become the dominant concern – as such, manufacturers will require resilient municipal supply or will be pushed towards UPW recycling.

A supply chain vulnerability

Adding to these pressures, fabs continue to agglomerate in areas of water stress, where climate variability and rising competition for municipal supply are increasing their exposure to operational disruption. Water still rarely decides where a fab is built. Location choices tend to prioritise grid stability, incentives, supply chain depth and natural disaster risk, so capacity still clusters around Taiwan and the US Southwest. Estimates in the paper suggest that close to a third of global fab capacity now sits in extremely water-stressed basins, just as climate extremes and aging public infrastructure make supply interruptions more likely.

For downstream customers, this concentration turns local droughts and infrastructure failures into systemic supply chain risk. Short term mitigation measures – like TSMC’s reliance on mobile water deliveries during a 2021 drought – are costly and highlight the limits of existing resilience strategies.

A critical moment for the semiconductor sector

Fabs must therefore look to alternative, climate-proof sources of water for future resilience. The whitepaper analysis suggests that the additional water required by AI could be met without increasing global freshwater withdrawals if industry and utilities collaborate on wastewater reuse and leakage reduction. Industrial-municipal partnerships in wastewater reuse offer the greatest potential in offsetting the rising water demand of chip production. Not only can this grant fabs an uncontested water source, but it can strengthen their social license to operate, which is likely to come under pressure as AI water use increasingly comes into view of local communities.

Download the full whitepaper to learn more :

Full whitepaper download