Semiconductor in numbers: Fab water sources

Share this insight

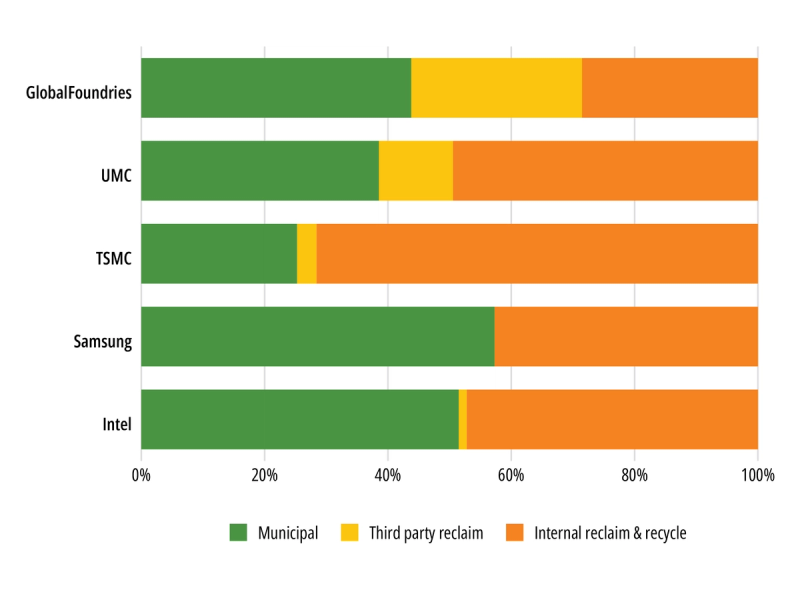

This chart shows the proportion of internally reclaimed water used alongside external sources for the top five semiconductor manufacturers by market share (excluding SMIC due to a lack of published data).

Taiwan’s semiconductor industry, led by TSMC and UMC, is at the forefront of water reuse adoption, with companies using more reclaimed water than freshwater. In 2023, TSMC achieved a process water recycling rate of 90.3%, while UMC reached 84.3% overall, and 90.8% for its Fab 12a in Taiwan. Chronic drought risk and water scarcity in Taiwan have accelerated the adoption of advanced water recycling and reclaim technologies, far outpacing other regions.

Taiwan’s water reuse efforts aim to reduce reliance on municipal water supplies. Major investments in the TSMC Water Reclamation Plant at Southern Taiwan Science Park, and the Yongkang facility in Tainan (operational since 2023), are central to this strategy, combined providing 62,500 m³ of reclaimed water daily for semiconductor manufacturing processes. This significantly enhances TSMC’s resilience to drought and potential municipal supply interruptions.

GlobalFoundries uses a mix of internal recycling, Singapore's NEWater, and freshwater – depending on regional context. Unlike TSMC and UMC, GlobalFoundries’ water reuse strategy is less connected to operational risk, as it primarily operates in low water-stress regions. As a result, water choices focus more on sustainability, cost-effectiveness, and maintaining their social license to operate. While environmental goals still drive reuse, the urgency and scale are less pronounced, particularly where factors like high energy costs, such as in upstate New York, come into play.

Significant treatment costs incur when reaching the high levels of reuse seen in Taiwan, and while these are necessary for business continuity in high-risk regions, in lower risk areas, the sustainability and reputational benefits alone are not enough to justify this investment. Consequently, companies in lower-risk regions often recycle cleaner water streams where there is a clear return on investment but opt to supplement this withadditional water from municipal sources over investing in the more expensive treatment of difficult wastewater streams. This can be seen in GlobalFoundries’ approach, which utilises internal reuse, but also relies on municipal freshwater and reclaimed water.

Additionally, Intel’s sites in regions like Arizona face high water stress due to competition for limited resources, though the actual risk of severe drought is considered relatively low. As a result, infrastructure investments are generally sufficient to mitigate threats to business continuity. For example, at the Chandler, Arizona site, Intel collaborates with the City of Chandler on an annual reclaimed water agreement. In 2024, they opened a jointly funded $44.6 million Reclaimed Water Interconnect Facility, to benefit both municipal and industrial users. This contrasts with semiconductor fabs in Taiwan, where variable rainfall and reservoir levels cause frequent water rationing, driving facilities to aim for total water self-sufficiency instead of relying on external sources.

Share this insight