5 Secrets to Success for Semiconductor Industry Entrants

Share this insight

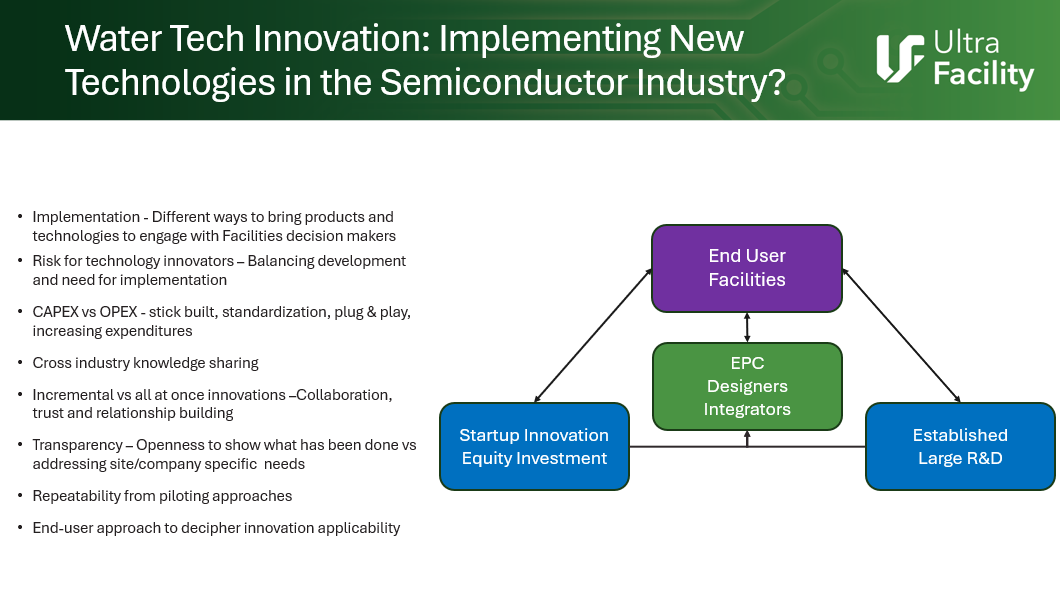

As announcements of global domestic manufacturing incentives, such as the US CHIPS Act, have brought infusions of capital investment into the semiconductor industry, eager water technology providers have also flooded in, seeking to take advantage of the industry boom. On the one hand, water security concerns and the rising importance of sustainability goals have increased the relative spending on water for microelectronics. On the other, many new technology innovators struggle to establish themselves in this risk-adverse industry. The most recent UltraFacility Webinar brought new light to what it takes for a water solution to be successful in the semiconductor context.

We invited 6 industry experts to give their perspective on how to make water solutions investable, adoptable, and scalable for the semiconductor industry:

- Kelly Osborne, Senior Staff Engineer, Intel

- Rob Simm, Senior Vice President, Stantec

- Alexandra Gaudette, RD&E Program Leader – Microelectronics, Nalco Water, an Ecolab Company

- Greg Newbloom, CEO, Membrion

- Kevin Chen, Managing Director, Lam Capital & Corporate Development, Lam Research

- Mike Knapp, Senior Industry Consultant, Nalco Water, an Ecolab Company (moderator)

Here are 5 key takeaways, summarizing their perspectives.

1. Start-ups must solve a real industry pain point, not just pitch cool technology

Chen opened the investor perspective by explaining that ‘a common pitfall is that entrepreneurs are very enamoured with their technology… but do not put enough emphasis on truly understanding the [customer] paint point, whether that is financial or operational.’ He explained that, although investors evaluate what is unique about the patents, they really focus on the market size, potential and customer traction for the technology.

As such, Simm explained where he sees the pain points – and therefore the opportunities – for water technology in the semiconductor industry:

- Resolving high treatment costs: a typical 10 MGD semiconductor water treatment facility can cost $800 million. Cost reduction is a key parameter.

- Rapid installation: modular solutions and offsite manufacturing/commissioning are in high demand.

- UPW Recycling: water scarcity drives the need to recycle wastewater to the UPW front-end, but there is a risk to wafer quality from the presence of low molecular weight organics (LMWO). A real opportunity exists for LMWO analytical technology.

- PFAS management: Semiconductor fabs are investigating detection, removal, and destruction solutions.

2. Pilots must be low-risk, high-fidelity – or they won’t happen

Osborne opened up the end-user perspective of the webinar, showing the size and complexity of the mega-factories which must be protected during a pilot. Any kind of interruption can easily cost a semiconductor fab millions of dollars. Avoiding wafer quality impacts and ensuring site compliance are also critical factors in a pilot risk analysis. The complexity of modern fabs only makes this more challenging, as integrating a new technology into an existing factory involves in-depth analysis and monitoring to understand the potential impact to various systems.

3. The reality is that risk mitigation is difficult and reliant on data

The crucial requirement for suppliers to reach the pilot phase is data. Whitepapers alone are unlikely to lead to a high-volume manufacturing pilot, but benchtop testing can enhance datasets, minimizing the uncertainty about the potential impact to facilities, and provide the basis for a small-scale pilot. Osborne explained that Intel, among other manufacturers, has smaller-sized facilities for technology development where pilots can be tested.

Gaudette showed how, as a larger technology provider, Nalco used in-house pilot systems to adapt a solution from the power generation industry to semiconductor. The data already exhibited in another industry (with less complex reliability requirements) helped significantly. Thereafter, in-house pilot facility with 12 cooling towers could screen a corrosion inhibitor replacement at different water conditions – a particularly useful capability in light of the consistently changing and complex waste profile of semiconductor fabs. To learn more about this case study, view the UltraFacility 2024 presentation.

4. Start-ups should focus on techniques to enhance operational certainty

Newbloom explained Membrion’s ten-year perspective as a start-up in the semiconductor industry, emphasizing that new technology cannot impact long-term operational certainty. For example, if you deploy a new technology which is sufficiently different from other available solutions, there is a risk in the provision of replacement components which might be based on a single company’s intellectual property.

The ability to retrofit technology alongside existing unit operations is a key success marker, which requires a compact technology. The risk of technology implementation is reduced by placing it in tandem with legacy equipment which can handle a wide variation in fab wastewater flows and concentrations, but the availability of on-site space is a challenge.

5. Continued success is achieved via collaboration and business model innovation

Osborne advises: ‘see your end-user as a partner rather than a buyer’. Sometimes pilots fail, but end-users are open to collaborating and understanding whether adaptations to the technology or pilot conditions could achieve success. In addition, Osborne highlighted that technology suppliers will have greater success if they can provide continued services and incremental improvements in the long-term.

A recent example of collaboration and business model innovation is the Water Service Agreement (WSA) between Membrion and Lam Research. Start-ups face major adoption risks because of the uncertainty around the long-term cost projections. Membrion removed the customer’s risk by taking on both upfront and OPEX costs, with the customer paying for performance. Membrion improved operational certainty for the customer by shrinking waste streams which were filling up tanks, without introducing a cost risk. To explore this case study further, view the recording of the UltraFacility 2024 presentation.

--

For the full perspectives of all our panellists, view the full webinar recording here.

Do you have solution and data to show the semiconductor industry? Submit an abstract by June 27 2025, for the chance to present in front of semiconductor end-users and their supply chain.

Share this insight

Collaborators

Mike Knapp

Senior Industry Consultant

Ecolab

Kelly Osborne

Senior Staff Engineer

Intel

Rob Simm

Senior Vice President

Stantec

Alexandra Gaudette

R&DE Program Leader - Microelectronics

Nalco Water, An Ecolab Company

Greg Newbloom

Chief Executive Officer & Founder

Membrion Inc

Kevin Chen

Managing Director

Lam Capital

Organizations

Intel