Tech Talk: Short Chains, Big Challenges for Semiconductor PFAS Destruction

Share this insight

Despite accounting for a relatively small share of global PFAS consumption, the semiconductor industry has rapidly emerged as one of the most attractive near-term markets for PFAS destruction in wastewater within the US and Europe. However, a new dynamic comes into play from August 2025, as the US Commerce Department of Commerce withdrew the $35 million Natcast PRISM fund for scaling PFAS remediation technologies for semiconductors.

The competitive landscape is at a tipping point where it might consolidate or shift towards private partnerships for scaling newer technologies.

A market with clear intentions

Technology providers are drawn to the industry for three key reasons: future liability concern is high, alternatives to its ubiquitous applications are scarce, and capital planning is defined by risk-aversion.

Alec Ajnsztajn, CEO of Rice University start-up Coflux Purification, explained why the semiconductor industry is an important market from his perspective: “In the semiconductor industry, PFAS cannot be phased out in the near future by substitute chemicals. Also, in comparison to other industries, it is proactive in defining requirements around 10–15-year roadmaps.” He referenced guidance from the SIA PFAS consortia and SEMI working groups.

While the uncertainty of the future regulatory landscape in the US may somewhat slow investment in PFAS remediation, semiconductor manufacturers are ultimately proceeding with pilots. As Brian Pinkard, CTO at Aquagga, told UltraFacility: “There is a misconception that PFAS treatment is a regulatory-driven market – it is actually a liability-driven market. There is a whole family of compounds. Some are regulated now, some are not, but all carry some amount of liability.” For fabs, the unregulated PFAS compounds are essentially future regulations waiting to happen, making future-proofing essential.

The EPA’s April 2024 designation of certain PFAS chemicals as hazardous substances under Superfund dampened US-based semiconductor manufacturers’ aspirations to incinerate off-site PFAS and pushed consideration of destruction methods with more predictable liability outcomes.

Dora Chiang, global principal for PFAS and emerging contaminants at Jacobs Engineering elaborates: “Although on-site destruction is more difficult, with lots of considerations such as specialty trained employees, employees, additional concerns on management of PFAS destruction wastes, such as air emissions and management of PFAS destruction effluent, many manufacturers still opt to destroy in case future liability for off-site PFAS changes.”

Full destruction is the top priority, including short chains

In this market, technology selection will be judged less by current rules, and more by how well a solution can eliminate tomorrow’s regulated compounds. This makes short- and ultrashort-chain PFAS destruction a differentiator, so operators do not need to retrofit or rip out an unsuitable solution in several years.

John Tracy, Vice President of Global Business Development at Aclarity explained: “There are a few challenges which make the semiconductor industry unique, and a key one is the prevalence of short and ultra-short chains which are harder to detect and destroy. Compounds like PFBA and PFBS look like they could be restricted in the US in the future and already have some European regulations.”

Confirming the end-user perspective, Darrell Dumont, water strategist at Texas Instruments told UltraFacility: “Future-proofing to meet today’s requirements and the emerging requirements is critical, so if ultra-short chains will be regulated eventually, manufacturers will want to make a decision for a technology which can be modified and expanded.”

As such, the ‘gold-standard’ of full PFAS mineralization is important in this market. A staff engineer at a US-based top-tier semiconductor manufacturer told UltraFacility: “One of the concerns I have with some destruction methods is not completely destroying PFAS, so how can we ensure byproducts do not recombine?” This concern would apply to certain providers of electrochemical oxidation or plasma-based methods which are working to prove full mineralization.

Igor Novosselov, professor at the University of Washington explained this problem: “Ultra-short chain PFAS compounds like TFA are very stable and mobile and can persist in the environment in liquid and vapor phase for long time. The sources of these PFAS can be industrial wastewaters or they can be formed as a byproduct of incomplete PFAS destruction in some destructive processes.” He further explained why these are difficult-to-handle emerging contaminants. “Ultrashort PFAS do not bind well to common, commercially available sorbents like granular activated carbon or ion exchange resins, meaning traditional separation technologies have a hard time capturing it.”

Technology selection starts with knowing what is in the water

Five major technology types are emerging as front-runners for destruction methods, at different levels of commercialization. Each option faces headwinds in this market due to the unique chemistry and variability of semiconductor wastewater streams.

“The industry needs to continue identifying PFAS pathways and stream profiles. Once we have a better understanding of the sources, we can plan segregation and treatment strategies,” explained Brad Herbert, process technical lead for advanced facilities at Jacobs Engineering. “Without that, it is hard to know what destruction technology even fits.” Herbert added that process changes can also add constituents to the waste stream, creating new challenges for the treatment.

This complex nature of fab wastewater brings up a critical conversation around co-contaminants. “PFAS destruction technologies rely on very aggressive processes and are not selective,” Chiang elaborated. “The technologies treat organics. So, the inclusion of organic co-contaminants such as high COD and high BOD in the waste stream will drive up energy consumption.”

Chiang also pointed to complications beyond organic contamination in wastewater: “SCWO is very effective in destroying any kind of organics, but high chloride may cause corrosion issues. HALT is a great technology, but low pH water will need added caustic. So, pH, salt contents and organic contents are the most common considerations when in technology selection.”

Herbert pointed to the industry direction: “We are seeing a trend of more aggressive water reclaim which leads to more concentrated wastewater streams. Higher concentrations of contaminants create more challenges for both the separation and destruction technologies.” Specific compounds prevalent in semiconductor waste streams which might complicate separation and destruction include ammonia, copper, CMP waste, solvents, and suspended solids.

Although remediating PFAS in segregated streams is complex, it seems to currently be a favourable approach over centralized treatment. “I have yet to find a technology which seems effective for end-of-pipe treatment at high flow, low concentration and is economically feasible,” explains Sarah Wallace, water strategy manager at Texas Instruments. The landscape indicates that, in the short-term, understanding stream segregation will be key to the PFAS destruction success story.

Overall cost is the key opportunity for technologies to stand out

For fabs, total cost of ownership and the minimization of long-term operational risk outweigh most other factors.

Exploring the priorities of cost and risk, Novosselov explained: ‘The energy consumption of PFAS destruction technologies is insignificant compared to the capital investment in the equipment, as well as considerations like who operates the equipment and the sourcing of replacement parts.’ The long-term viability of some of the start-ups, who are proponents of such destruction technologies, is a key consideration for end-users, especially if there are speciality materials in their proprietary products.

The business model emerges as a key opportunity for these technologies to break through. Pinkard explained that it is possible to de-risk the deployment of technologies by utilizing an almost water-as-a-service type agreement where the technology provider takes on the operational and financial risk and can manage the expected life of certain components. Aquagga is one such company which is investigating operating under a service agreement.

Ajnsztajn added a key limitation in the end-user understanding technology adoption: “The industry has to be aware of the total cost-of-ownership for its full 20-year installation, but the industry does not really have good models for that.’

Full mineralization also ties into the question of overall costs and risk, as Wallace explains: “The volume of waste generated ties into the overall cost of destruction. End-users will be interested in the byproduct from the destruction, and the question of whether the vendor can demonstrate the level of PFAS in the remaining waste.” She explained that this intrinsically linked to the cost of disposal.

A potential market for newer technologies

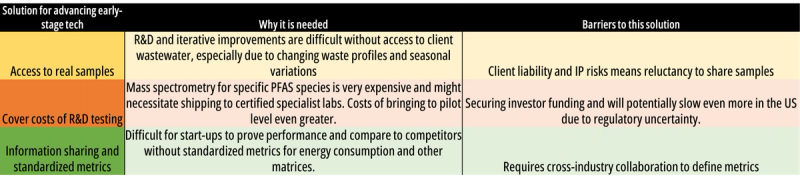

For early-stage PFAS destruction innovators, the semiconductor market offers opportunities, but a steep on-ramp. Success depends on bridging scale-up gaps, proving economics at fab-relevant flows, and securing the collaboration and funding needed to compete with more commercialized players.

Early-stage PFAS destruction technologies experience significant barriers to lowering residence times. Chiang uses the specific example of promising UV-Sulfide systems, which show good results but have not been supported enough to commercialize: “These technologies probably only have a 5 gallon/minute scale, and the industry demands larger reactors. They likely do not have much funding or project opportunity to help them scale-up.”

The aforementioned cancelled PRISM fund was well-poised to support start-ups to overcome these hurdles, but in its absence the industry must discuss alternative avenues for financial support and other collaboration means.

Ajnsztajn explained: “As a start-up, we want to solve people’s problems, but if the industry wants to bring a new technology to the market, they have to be willing to take on some of the validation costs.” He added “There also needs to be greater transparency in sharing literature and standardizing metrics to compare technologies in a meaningful way.”

For further insights on how the semiconductor industry embarks on piloting and scaling industries, see this article on success criteria for new entrants.

Glossary

BOD – Biological Oxygen Demand

COD – Chemical Oxygen Demand

HALT – Hydrothermal Alkaline Treatment

PFAS – Per-and poly-fluoroalkyl substances

PFBA – Perfluorobutanoic Acid

PFBS – Perfluorobutane Sulfonic Acid

SCWO – Supercritical Water Oxidation

SIA – Semiconductor Industry Association

TFA – Trifluoroacetic Acid