Tech Talk: High Recovery RO in the Semiconductor Industry

Share this insight

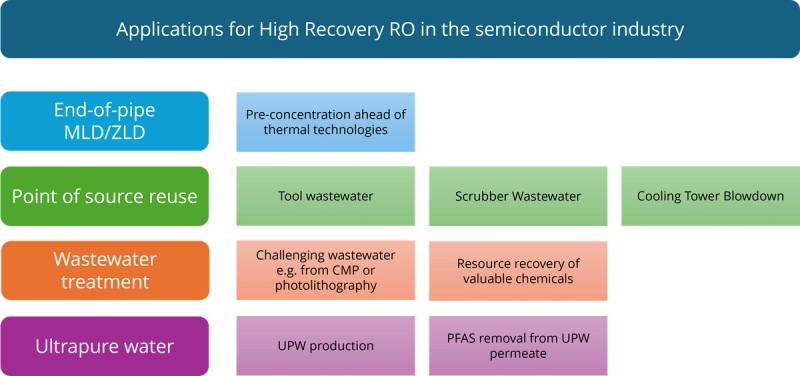

MLD and ZLD are driving burgeoning demand for high recovery reverse osmosis (RO) within the semiconductor industry – and varied waste streams leave room for diverse membrane types.

New drivers within a high-volume market

According to GWI data, the microelectronics market is the biggest industrial spender on membrane concentration technologies in the water sector. Semiconductor manufacturing is already a sizeable market for RO, as it is essential across the fab, but demand for high recovery RO (targeting over 75% recovery) will grow even more strongly, especially in water-stressed regions.

Whilst the applications for high recovery RO are numerous in semiconductor fabs, the biggest shift in demand stems from the surge towards end-of-pipe MLD and ZLD schemes. Here, high recovery RO is used as a pre-concentration step to reduce the size of costly thermal brine concentrators.

While cost was previously a barrier to MLD and ZLD for most semiconductor fabs, water stress and local regulatory drivers have prompted fabs to minimize discharge regardless of the return-on-investment. Ben Sparrow, CEO at Saltworks explains: “The more you reuse, the more you concentrate, which means the risk of exceeding discharge limits increases. This triggers the need for partial or full ZLD.”

Another emerging driver for high recovery RO is the potential of PFAS regulations impacting the semiconductor industry, especially in the US. Whilst uncertainty over the final PFAS limits may constrain mitigation projects in the short-term, multiple fabs have piloted RO-based PFAS removal installations. This regulatory uncertainty in itself drives ZLD, as the 2024 IRDS Sustainability Roadmap States: “The concerns on certain groups of PFAS chemicals may also be a driver for brine management, as resulting ZLD ensures no traces of harmful chemicals may end up in the environment.”

Stream segregation drives both membrane diversity and end-user frustration

The drive towards water reuse has prompted semiconductor fabs to adopt more intensive stream segregation strategies, in turn driving adoption of more diverse membrane technologies.

“In the past, all wastewater was combined into one stream and sent to an industrial wastewater treatment plant,” explains Megan Lee, account executive at Hydranautics. “But greenfield facilities now separate individual waste streams allowing opportunity for different membrane technologies – for example those targeting highly acidic solutions or caustic streams.”

Her colleague Wayne Bates, engineer at Hydranautics added: “Various systems integrators have developed proprietary technologies, which all look different. There may be 200 organic or inorganic chemicals stated in the wastewater of a semiconductor plant. As all waste streams have their own unique characteristics, there is a multitude of technology options to deal with them.”

One US-based top-tier semiconductor fab expressed to UltraFacility: “With ZLD you have to build the complexity into your facility and separate your waste into perhaps 15-20 unique streams. Design is difficult because different supply chain partners suggest different numbers of RO arrays and various configurations.” Despite frustration with the complexity and lack of standardized solutions, he explained that success lies in continued collaboration. “Our ZLD operation is very sensitive to changes, and we did not find a one-size-fits-all solution – so you really have to become bedfellows with your suppliers and work together to adapt solutions to your facility.”

In a varied tech landscape, a few developments stand out

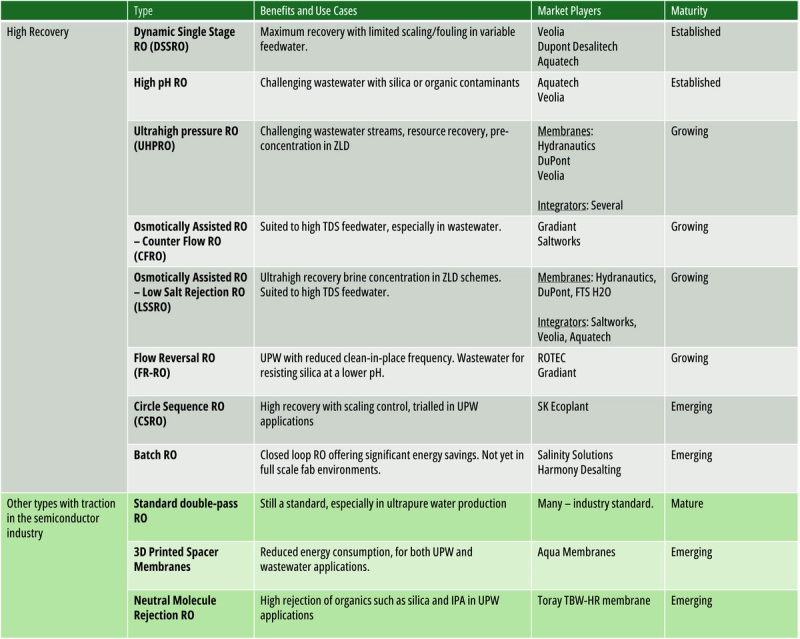

In MLD and ZLD schemes, a few key technologies stand out, depending on the user’s feedwater and waste profile. Osmotically Assisted RO (OARO) is particularly significant development in the semiconductor industry, and comes in multiple configurations, including CFRO, LSSRO, and FO-RO.

Aquatech has a long-established OARO-based ZLD scheme and the largest market share across all industries, but it is also promoted by growing integrators such as Saltworks. It stands out for ultrahigh recovery suited to high TDS applications (such as cooling tower blowdown) and can concentrate saline solutions to approximately 200,000 milligrams per liter. It typically lies between a high pH RO membrane and a crystallizer to reduce the size of more costly thermal technologies.

Other membrane providers are focusing their innovations on avenues for cost-savings. For example, ultrahigh pressure RO – which is also used for pre-concentration of brine – promotes another use case by recovering valuable resources in challenging wastewater streams. Fabs can recover chemicals such as TMAH, phosphoric acid and IPA, as promoted by providers such as Hydranautics. Emerging examples include Aquatech’s patent-pending Cascade RO for IPA recovery in semiconductor manufacturing.

A different route to stand out is membrane innovation for OpEx reduction to offset overall system costs. Several fabs have installed FR-RO – not a new, but a growing technology – which provides high recovery and promotes chemical cost saving when treating challenging wastewaters. For example, Max Finder, Head of U.S. Sales at ROTEC explained using FR-RO “can improve the performance of legacy HERO systems, operating at higher recovery rates and pH of 9 instead of 10.5. Flow reversal and block rotation processes resist silica scale formation without requiring a high pH – this provides considerable cost savings on caustic additives”.

An alternative solution which has achieved semiconductor industry uptake by reducing overall costs in reducing chemicals, disposal and power consumption. IDE Technologies’ MaxH2O desalter, which promotes lower pH RO in tandem with crystallization in a fluidized bed. This approach was adopted at a Singapore semiconductor fab in collaboration with Haskoning’s Crystallactor technology. This innovative method offers potential relief from the consumable and energy demands of conventional high-recovery systems.

Opportunities within ultrapure water exist, but high recovery is not always the priority

In UPW production, the multi-stage, two-pass RO system remains the industry benchmark. The emerging RO landscape in UPW is more mixed – some water-stressed fabs look to maximize recovery, whereas other manufacturers focus their membrane efforts on reducing energy consumption or contamination.

UPW is considered a possible use case for DSSRO but this target application comes with extra design considerations. “DSSRO systems operate on a flexible and decoupled platform, with recovery, flux and crossflow as independent variables, allowing fabs to maximize water recovery as a function of real-time conditions. Significant advantage lies in applying this to abatement scrubber reclaim stream with a high potential for biofouling or silica scaling due to the superior hydraulics, salinity cycling and time-based approach that leverages induction times,” explained Michael Boyd, Domain Leader at Veolia. “Although it can be applied on the UPW system as well, the variable permeate conductivity would need to be taken into consideration when designing the downstream EDIs,” he added.

However, other high recovery RO technologies are gaining traction in UPW. For example, ROTEC recently installed FR-RO for UPW production at an Asian chip plant achieving 96.5% recovery for 1 year without requiring a CIP. Other trials show an ongoing willingness to optimize recovery – for example SK Ecoplant ran Circle Sequence RO (a hybrid flow-reversal semi-batch process) reaching 95% recovery rates in fab-scale UPW production testing environments in South Korea.

Ultimately, much membrane innovation for UPW targets priorities other than high recovery. Notably, Toray has introduced a neutral molecule rejection membrane offering improved removal of organics like silica and IPA—contaminants of growing concern as chip geometries shrink. Another area of interest for RO membranes for UPW production is energy reduction. For example, in a pilot at Micron’s Boise site in 2024, Aqua Membranes’ 3D-printed spacer membranes reduced the differential pressure buildup and cut energy use by 29% compared to conventional RO in the second stage pilot.

Market entry is difficult but there are opportunities to stand out

Whilst there are barriers to entry in this market, the complexity of these wastewater configurations poses an opportunity. On the one hand, the industry is risk-averse since 24/7 uptime is the highest priority for any facility, meaning end-users prioritize providers with a proven track record.

On the other hand, the varied challenges of different waste streams mean that end-users are willing to try creative configurations, pointing to market entry opportunity. One semiconductor manufacturer told UltraFacility that they piloted a new ZLD concept in a smaller technology development facility in Asia – signalling room for validating innovative technology approaches.

End-users’ concern over the cost and complexity of ZLD also represents opportunity for innovative project delivery methods for high recovery RO. Sparrow told UltraFacility that “there’s a way to reduce the cost of ZLD which includes point-of-use water treatment and bifurcating the flows, incorporating ultrahigh brine concentration RO systems upstream. If you deliver these methods through offsite-constructed modular units, it brings significant savings.” Sparrow went on to quote the installation cost factor as being 3-4x the equipment for conventional ZLD, but only 1.3x the equipment for a modular approach.

There is a real opportunity for repeatable, fungible units to facilitate speed and cost of installation, and to build in redundancy. Another example of an emerging approach is multi-tube pressure vessels which reduces the required number of high-pressure piping connections. This plug-and-play form factor, such as The Barrel promoted by Veolia, features permeate mapping utilizing smart connectors. The transition from dozens of high-pressure victaulic fittings to two bolted flange fittings provides an additional layer of safety, particularly on high and ultra-high-pressure RO applications.

AI is on the horizon

AI technologies for RO are nearing readiness for deployment in the semiconductor industry, driven by a shortage of experienced plant operators. For example, Rockwell Automation has showcased software for AI-driven CIP recommendations for RO in the semiconductor industry. Furthermore, Veolia is developing generative AI dashboard for real-time RO optimization with maintenance forecasting.

“We will see technology emerge that can dynamically respond to situations, whether that is increased diagnostics in real time, or the decision-making around what to do with that information,” said Finder at ROTEC. “Increasingly, we’ll see that digital technology can run the plant, and the operator's job and capability will be enhanced by some of these technologies.”

Still, as is the case for many technologies, resistance remains among some manufacturers to adopting 'off-the-shelf' AI systems for RO, opting to integrate AI into their own tailored digital infrastructure to streamline data control and incorporate their own robotic operators. In either case, there is significant potential for advancing Advanced Process Control – including improving sensor calibration and developing better instrumentation for wastewater monitoring to raise data quality and support smarter automation.

Glossary

- CIP – Clean-in-Place

- COD – Chemical Oxygen Demand

- IPA – Isopropyl Alcohol

- IRDS – International Roadmap for Devices and Systems

- MLD – Minimum Liquid Discharge

- NF – Nanofiltration

- OpEx – Operational Expenditure

- PFAS – Per and poly-fluoroalkyl substances

- TDS – Total Dissolved Solids

- TMAH – Tetramethylammonium hydroxide

- TOC – Total Organic Carbon

- UF – Ultrafiltration

- ZLD – Zero Liquid Discharge

Share this insight