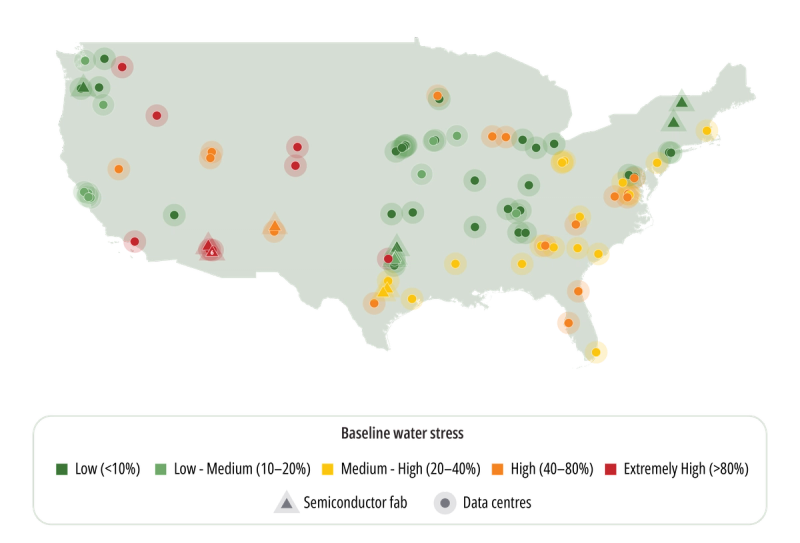

Semiconductor in numbers: Mapping Water Risk Across US Fabs and Data Centers

Share this insight

This map shows the locations of US semiconductor fabs and data centers for the five largest companies in each industry. It is color coded by baseline water stress using the Aqueduct Water Risk Atlas. The text breaks down the wider water risk indicators to highlight threats specific to each sector and potential areas for collaboration

While semiconductor fabs are often located in high-risk regions, many data centers also face elevated baseline water stress. Data centers show greater exposure to drought risk, particularly across the Midwest. Both industries experience high drought risk in Texas, which is one of the fastest growing regions for data centers, but is yet to implement robust water reporting and planning.

Arizona ranks among the nation’s highest-risk regions for water scarcity yet continues to attract fabs and data centers. This paradox reflects the state’s forward-leaning water planning, which has helped sustain it as a digital infrastructure hub. Arizona was the first to model water supply a century ahead and, in 2022, committed $1.2 billion over three years to water infrastructure. While low seasonal rainfall variability and access to the Colorado River provide short-term resilience, industrial and municipal demand already exceed renewable supply. As droughts intensify, effective water management is critical- highlighting the tension between Arizona’s long-term scarcity and its continued attraction for water intensive industries.

Forward-looking semiconductor firms like Intel are partnering with municipalities to secure and reuse water and invest in watershed restoration to sustain operations in water-stressed regions like Arizona. Initial efforts have also been made from data centers, with Microsoft Azure opening the Quincy Water Reuse Utility (QWRU) in 2021, partnered with the city of Quincy, Washington, to process cooling water for reuse by local industries, creating a closed loop system so wastewater isn’t discharged, and potable water intake can be reduced.

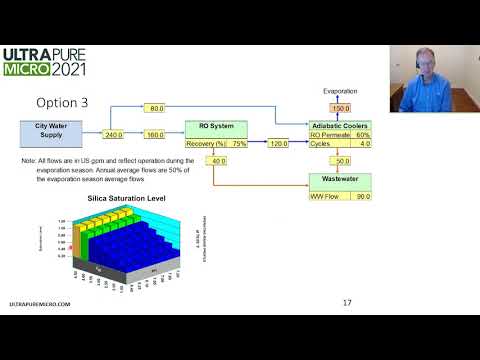

While the two industries have differing water needs, with fabs requiring ultrapure water for manufacturing, and data centers primarily consuming water for cooling, there is an opportunity for joint investment in innovative water stewardship, and existing efforts could be strengthened through collaboration. Public-private partnerships and water-as-a-service models enable both sectors to co-fund infrastructure upgrades, expand reuse, and adopt sustainable sourcing, reducing water risk, cost, and drought vulnerability while enhancing resilience and social license to operate.

There are also opportunities for the two industries to exchange insights and best practices. On Day Zero, December 3, in Austin, the Ultrafacility Conference will feature a workshop on these shared challenges:

Power & Cooling: Engineering Resilience into Semiconductor and Data CentersShare this insight