Semiconductor in numbers: Global fab construction timelines, from breakthroughs to breakdowns

Share this insight

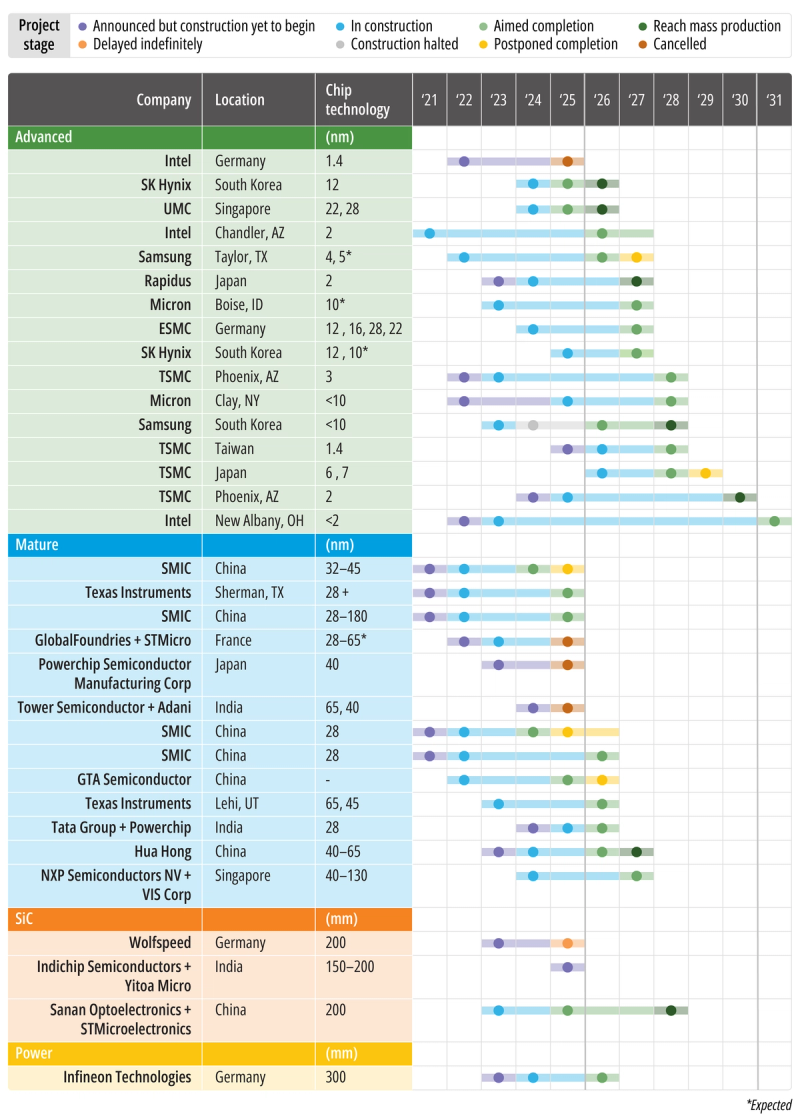

This chart presents an overview of 33 high visibility global semiconductor fabrication projects, including 29 active initiatives currently in the planning or construction phases, and 4 projects that have been cancelled or postponed indefinitely in 2025.

The US is securing some of the world’s largest long-term semiconductor investments. TSMC’s $165 billion Phoenix development, first announced in 2020 with an initial $65 billion for three fabs and expanded by a further $100 billion in 2024, for a total of six fabs, aims for 2nm volume production by 2030. When complete, this complex will supply 30% of TSMC’s most advanced chips.

Additionally, Texas Instruments is investing $40 billion in Sherman, Texas, with the first of four fabs to open this year, and further fabs phased though to 2030 and beyond. Intel is also prioritizing investment in advanced manufacturing in the US, having cancelled projects in Germany and Poland, but moving forward with $32 billion in new Fabs 52 and 62 in Chandler, Arizona, scheduled for completion in 2026 and 2027 to produce 2nm chips. Its $20 billion Ohio project, launched in 2022 and expected online in 2026–27, could eventually expand to $100 billion across eight fabs over the next decade. This surge reflects the effectiveness of the 2022 US CHIPS Act in attracting large-scale, advanced manufacturing. By contrast, the European Court of Auditors has recommended that the goals of the European Chips Act be reconsidered, as the region remains well off track to achieve its 2030 target of capturing 20% of the global semiconductor market.

Asia remains the greatest competition for the US, with leading edge chip production dominated by TSMC. TSMC has now leased land for a new fab at the Central Taiwan Science Park, dedicated to 1.4nm chips, preserving Taiwan’s role as a technological leader whilst hedging geopolitical risk by balancing leading-edge production in Taiwan with capacity expansion in the U.S. In Japan, Rapidus, only founded in 2022, aims to enter 2nm production by 2027, receiving $11.5 billion in financial support, including $5.4 billion from the Japanese government. Pilot line construction is set for this summer, but Rapidus still faces major challenges in attracting additional funding and securing customers to compete with established leaders like TSMC.

South Korea continues as a leader in the global memory market, with SK Hynix’s $3.86 billion M15X fab in Cheongju set to begin operations by the end of 2025, boosting next-generation DRAM output.

Chinese semiconductor manufacturing prioritizes scaling volume production in mature nodes due to U.S. export restrictions limiting access to cutting-edge technology. Manufacturers are targeting 28nm production, which shows stable market growth compared to both advanced and older nodes. Nearing completion are SMIC’s $8.87 billion Shanghai and $7.5 billion Tianjin fabs, both targeting 28nm, expected to start operations in 2025/26. At the same time, however, the sector faces challenges from so-called “zombie fabs”, projects that stalled due to technical shortfalls, lack of equipment, geopolitical obstacles, or bankruptcies. These facilities often consumed substantial state investment before being quietly abandoned, with limited public updates once progress ceased.

In specialty markets, silicon carbide fabs face challenges due to shifting EV demand. Wolfspeed’s Saarland fab in Germany is delayed indefinitely, while Sumitomo Electric cancelled its Japan fab, focusing instead on gallium nitride wafer technology.

Several international fab partnerships have collapsed, including the Tower Semiconductor-Adanis India fab for mature nodes, paused due to uncertainty in India’s semiconductor demand and commercial viability. By contrast, Powerchip ended its Sendai, Japan fab plans with SBI Holdings to focus instead on Tata’s India fab. These events highlight mixed optimism for India’s semiconductor sector, which sees many ambitious projects planned, but few materialize. This demonstrates the challenges in expanding to emerging regions, where market uncertainties and the high capital intensity of fabs are significant obstacles despite government support and incentives.

Share this insight