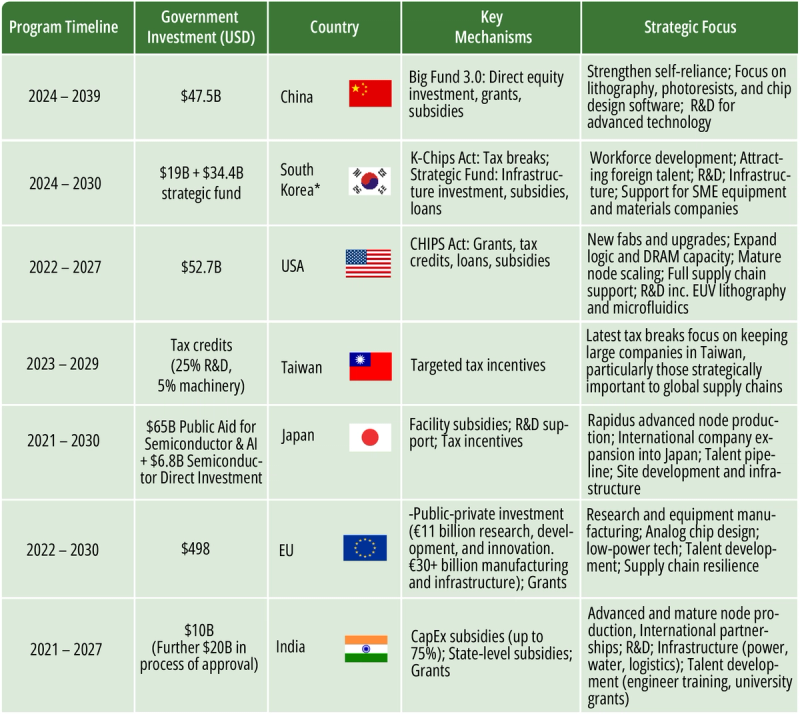

Semiconductor in numbers: The national semiconductor strategies funding the future of tech

Share this insight

This chart highlights the scale and structure of government investment programs in semiconductors around the world. While all major regions are committing significant funding, the mechanisms, ranging from subsidies and tax credits to long-term equity funds, reflect different strategic priorities.

Established Leaders

The US CHIPS Act has committed $52.7 billion, with Intel, TSMC, and Micron among the biggest beneficiaries. Of this, $39 billion was dedicated to manufacturing and facilities and $11 billion to target R&D and workforce development. However, the CHIPS act strategy is being reassessed under the new administration. Natcast’s $7.4B in funding has been cancelled, which includes the NSTC Workforce Center of Excellence. Thus far, the CHIPS act has been largely successful in attracting investment, and in 2025, the US is expected to make up 20% of the global semiconductor market share.

Since 2024, South Korea has committed $46.2B for semiconductor manufacturing, including$10 billion in loans is planned for 2025 to expand facilities and boost power supply for fab clusters. Although these efforts are extensive, there have been calls for more direct subsidies. Additionally, progress on the K‑Chips Act remains uncertain.

Taiwan’s programs focus on targeted tax incentives, expected to save TSMC about NT$30 billion annually. With semiconductors making up roughly 15% of GDP, the strategy centers on sustaining dominance rather than catching up, keeping major companies like TSMC investing in Taiwan.

Regions of Market Ambition

China is ramping up its long-term strategy with Big Fund 3.0. While supporting Chinas’ push for self-reliance, the fund must overcome past corruption and governance issues. Past investment allocations lacked due diligence and overemphasized chip design and fabs, neglecting research, materials, and equipment vital to a resilient supply chain. Phase III aims to address these gaps, targeting critical vulnerabilities dominated by foreign players.

Japan is attempting a comeback with $65 billion in public aid. Despite past leadership in the sector, its 2025 market is projected at $57.92 billion, just 0.71% of its GDP. While Japan’s 2nm ambitions are bold, securing customers and reaching mass production will be a challenge. Recent government incentives hedge some of this risk by spreading support across a broader range of companies. This includes incentives to attract international companies like TSMC, who already secured $4.86 billion support for its Kumamoto site.

The EU’s Chips Act commits $49 billion, targeting a 20% share of the global semiconductor market by 2030. The region’s 2025 market is forecast at $70.3 billion, 10% of global market share. In April 2025, the European Court of Auditors warns the 20% target is likely out of reach, recommending the strategy be reassessed. The audit cited weak tracking of investments and overconcentration in a few major firms. Structural hurdles also persist: Europe’s high labor costs undermine competitiveness, while complex legislation and administrative delays have slowed rollout compared with U.S. efforts.

Emerging Semiconductor Markets

In addition to the existing $10B invested, the Indian government is currently reviewing a $20B proposal for the next phase of the India Semiconductor mission 2.0. According to the India Semiconductor Market Report 2030, the sector was valued at $52 billion in 2024-25 and is expected to reach $103.4bn by 2030. Indias market growth is fueled by growing domestic demand and lower political risk,however,sustained government support and infrastructure upgrades are critical to securing investor confidence after past projects have failed to materialize.

Share this insight