PFAS Compliance in 2025: Key Regulatory Shifts for Semiconductor Manufacturing

Share this insight

Johnsie Lang is an environmental engineer at Arcadis, specializing in per- and polyfluoroalkyl substances (PFAS). She previously worked at the U.S. Environmental Protection Agency’s Office of Research and Development. Johnsie provided an interview to update Ultrafacility on the current U.S. regulatory landscape for PFAS and how fabs can adapt to stay compliant with changing regulations.

What are the most significant PFAS regulatory changes affecting US semiconductor manufacturing in 2025, and how do these compare to other regions such as Europe?

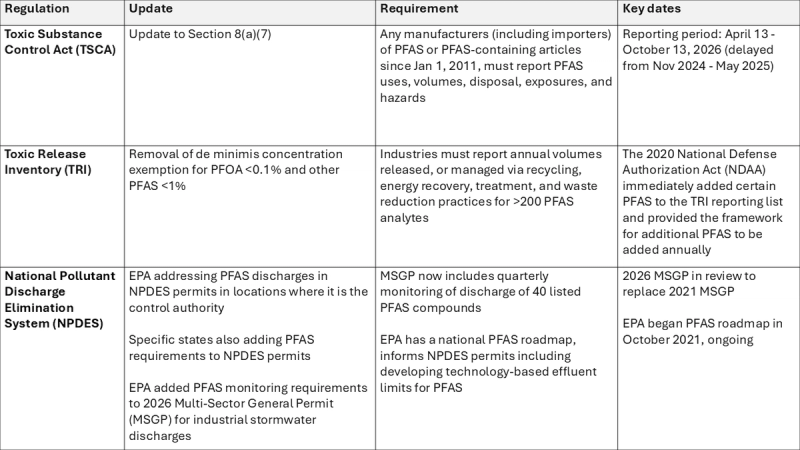

The most significant regulations are related to product reporting. Section 8(a)(7) of the Toxic Substance Control Act (TSCA) is updated, requiring suppliers, importers, anybody who imports or produces PFAS or PFAS-containing products in the United States to report lots of information. Significantly, the regulations prescribed reporting rules to all PFAS, and they really leave it to the industry to figure out what is PFAS or not, they don't have a specific list of chemicals.

Another big change is the Toxic Release Inventory (TRI) reporting. That's been coming out for several years now, but there are somewhere around 200 different PFAS that are currently required to be reported. The regulators recently removed the de minimis concentrations. Before, this applied to anything over 1% but now it's all PFAS concentrations.

The third regulation is the National Pollutant Discharge Elimination System permits (NPDES).These are industrial direct stormwater discharge or pretreatment NPDES permits, bridge, storm water or industrial wastewater. We see a lot of updates occurring related to the NPDES permit requirements. Currently, the focus is on monitoring and reporting discharges, but effluent guidelines are being developed for activities like metal finishing and landfills.

How are these expanded regulations creating new compliance challenges or supply chain disruptions for the semiconductor industry?

The main challenge I see with semiconductor clients is identification of PFAS in their product lines and in their supply chains. Essentially, PFAS historically haven't been included on safety data sheets (SDSs) and product specifications that so trying to understand where PFAS exists in your supply chain is a somewhat difficult thing.

How do they go about then identifying those PFAS in their supply chains?

Clients can AI use tools like search bots to go through and search for specific list of PFAS, collated from different lists throughout the world. We can search for the general term “proprietary fluoro alkyl surfactant”. There's not necessarily a chemical name or CAS number associated with that because it was proprietary, but because it's a surfactant, and it has the “fluoro alkyl” part in there it leads us to believe it's a PFAS so we can flag those in a separate category as well.

Is there more general actions that fabs can take to prepare for the future regulations tightening?

It's important at this point to get an understanding of where PFAS exist in your facility, where do they exist in your supply chain, what products, what chemicals, what things are you using that count as PFAS? Really getting a handle on that is the first step understanding where and what you're using.

What role do analytical methods like the EPA draft Method 1633 play in improving PFAS analysis and what are the limitations of that method?

Draft Method 1633 is the first method from the EPA where we can measure non-drinking water matrices. So, it allows us to measure things like groundwater, soil, landfill leachate, surface waters, with an approved method. Up until now we've been using a drinking water method to measure other matrices, so it improves our understanding of PFAS and non-drinking water matrices.

How do you anticipate the regulatory landscape evolving in the US and internationally? And what does this mean for semiconductor manufacturing sustainability? How's it going to shape that?

In the US, under the previous administration we were moving hard with PFAS regulations. I would say a lot of that movement has slowed and there are some things being rolled back. For example, the TSCA regulation which I mentioned earlier, the date for reporting has been rolled back, they've extended it, giving people more time. But I have no idea what is going to happen in the future.

The CHIPS and Science Act does not specifically mention PFAS, but it does include funding for research and development. Natcast was created as a non-profit organization to distribute those research funds and solicited grant submissions for PFAS Reduction and Innovation in Semiconductor Manufacturing (PRISM).PRISM was designed to be a $35M program with 10-15 awardees. Unfortunately, it appears the PRISM program was cancelled or postponed.

What role do you see analytics and digital tools taking in terms of compliance and risk management moving forward?

I think we continually improve our ability to use computers and analytics to do things faster and better. For example, with a search bot, what could have taken days or weeks to manually sort through thousands of PDFs, can now be sorted in a matter of minutes and prioritize what we are visually looking at. Very much so using it as a prioritization method going forward until we continue to grow.