5-year CAPEX Forecast - Spending on water for semiconductor manufacturing

Share this insight

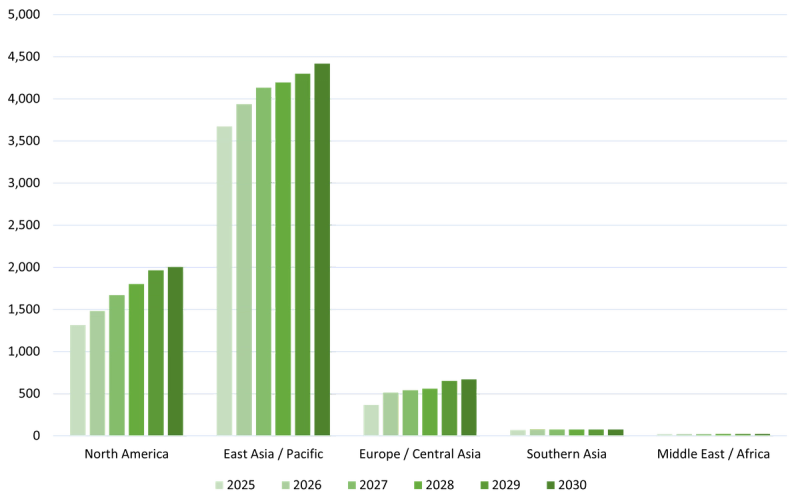

Global Water Intelligence presents a preview of a 5-year forecast for water-related capital expenditure for microelectronics up to 2030, focusing specifically on front-end semiconductor manufacturing.

In all regions, uncertainty in the global trade landscape will drive semiconductor manufacturers to take a conservative approach to spending in the short term, which could delay construction projects. However, given that semiconductor is a priority industry for many regions with strong government incentives, we anticipate that the market will be less affected by tariffs in the long-term, with investment picking up again around 2027. The increasing buildout of data centers is a strong driver of growth for semiconductors, since these facilities need vast processing power and advanced chips.

From a regional perspective, GWI expects that East Asia Pacific retains the largest market share thanks to key market players based in Taiwan, South Korea, and China.

Looking further into China, the semiconductor market is robust – although advanced node manufacturing is limited by restrictions on semiconductor equipment imports spearheaded by the US, China has a strong market presence for mature node chips. Given that most of the water and wastewater treatment supply chain is localized in China, any tariff-based disruption is likely to be minimal for water-related spending. One gap in the local market for water treatment technology is advanced metrology devices, the lack of which restricts Chinese semiconductor manufacturers from expanding into smaller node production.

Southern Asia’s expected growth rate in the near future has decreased from previous forecasts. – Although expectations from the Indian government’s incentive package spurred high hopes for boosting semiconductor manufacturing, the near-future does not yet show promise for a massive swing in investment. While the incentives have produced results – the first front-end manufacturing fab for semiconductors in India is currently under construction – investment in fabs focusing on front-end chip manufacturing has fallen short, with a greater focus on back-end and Research and Development.

Europe is an emerging market with a fast growth rate projected up to 2030. Historically this region has been a smaller market, focused on niche applications and legacy nodes requiring less water. New focus on building out advanced manufacturing in Germany is changing this, however – the ESMC plant in Dresden has sparked significant investment in water, and although delayed, Intel’s plans for a fab in Magdeburg should boost spending further in this country. Though the European Court of Auditors has predicted that Europe’s semiconductor industry will fall short of the European Commission’s ambitious target of 20% growth by 2030, by GWI’s estimates, it is the fastest growing region for CAPEX spending on water. The ECA’s recommendation that Europe should take steps to grow its semiconductor strategy comes as a ‘Chips Act 2.0’ is purportedly on the horizon for the EU that could drive investment in advanced manufacturing even higher.

Finally, for North America, the US dominates the north American regional market for front-end semiconductor manufacturing, demonstrating rapid growth because of a series of project announcements over the past few years supported by the CHIPS Act. Semiconductor manufacturing in water-scarce areas drives investment in water treatment for reuse to minimize the impact of this water intensive industry on the local environment. Zero Liquid Discharge is also increasing in popularity in the US, particularly for new fabs, as license to operate – both in social terms and in terms of permitting – depends on maintaining the water balance,

Currently semiconductor equipment remains exempt from consideration for US tariffs, but this could change at any moment as the Trump administration is pursuing a Section 232 review for this exemption. Existing tariffs on construction materials such as steel, aluminum and lumber could also impact spending on water by causing project delays that push back installation.

GWI WaterData users can access more granular forecast breakdowns here.

Share this insight